Through proper management of financial resources

理财规划是一个过程,通过适当的财务管理,以帮助满足个人达到人生所设的财务目标。

Financial planning for life involves:

财务规划包括 :

Risk Planning 风险规划

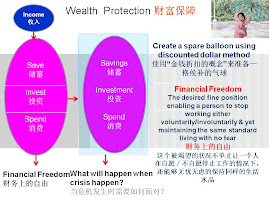

Wealth Planning 财富规划

Tax Planning 税务规划

And covers all major aspects of a person's life, such as:

涵盖个人生活的目标,例如:

Personal & Family Income Protection 个人及家庭收入保障

Protecting dependents – Special child & Elderly -disabled or suffering from a major illness.

家属保障 –特别是特殊孩童;老人及残障或严重病患者。

Minimizing of Tax 如何减少税收

Funding for emergencies设立应急基金

Children education儿女教育费规划

Retirement Planning 退休计划

Holiday & Vacation Planning 假期计划

Protection of assets against physical disasters 保护资产可能面对的灾害

Children‘s wedding 孩子的婚礼

Liability Cancellation 如何重组或减少债务

Protection of estate against creditors 保护财产可能面对的债务危机

Maintenance and distribution of estate 如何维护和分配遗产

Financial planning is not so difficult. Really. All one needs to understand is the process, which can be summarized as follows:

1. Know current financial status Determine what the current net worth (assets less liabilities) is. This is where one is now.

3. Set financial goals Define in monetary terms and targeted timing, taking into consideration major risk concerns. This is where one wants to be. The destination.

5. Develop a financial plan This would cover a selection of risk protection, financial and investment structures and strategies that suit one's risk profile. Like choosing which road to take. The highway is safer but longer. The shortcut is faster but may have more dangers. This is the plan - the chosen route that will bring a person from where he/she is now to where he/she wants to be.

6.Project financial outcomes Assumptions need to be made on investment portfolio returns, earnings growth and inflation. Like working out the journey distance and the speed of the vehicle.

7.Adjust the plan Assess if the projected financial outcomes meet the desired goals. When they are short, adjustments to the plan are needed either with the return, and hence the portfolio, or with the other anticipated inflows or outflows, or the goals need to be revised. Like deciding on final choice of vehicle, route and destination.

8.Execute Implement the plan. Drive!

9. Monitoring Track periodically to see if one is on course or not. Review whether changed circumstances warrant change in plan. Like watching the road signs and the dashboard to ensure route and progress of journey are as planned and whether conditions of the road or vehicle require route modification.